Our Matthew J. Previte Cpa Pc Diaries

Our Matthew J. Previte Cpa Pc Diaries

Blog Article

Matthew J. Previte Cpa Pc for Dummies

Table of ContentsThe smart Trick of Matthew J. Previte Cpa Pc That Nobody is DiscussingNot known Details About Matthew J. Previte Cpa Pc The 7-Second Trick For Matthew J. Previte Cpa PcMatthew J. Previte Cpa Pc for BeginnersMatthew J. Previte Cpa Pc Fundamentals ExplainedThe Matthew J. Previte Cpa Pc PDFs

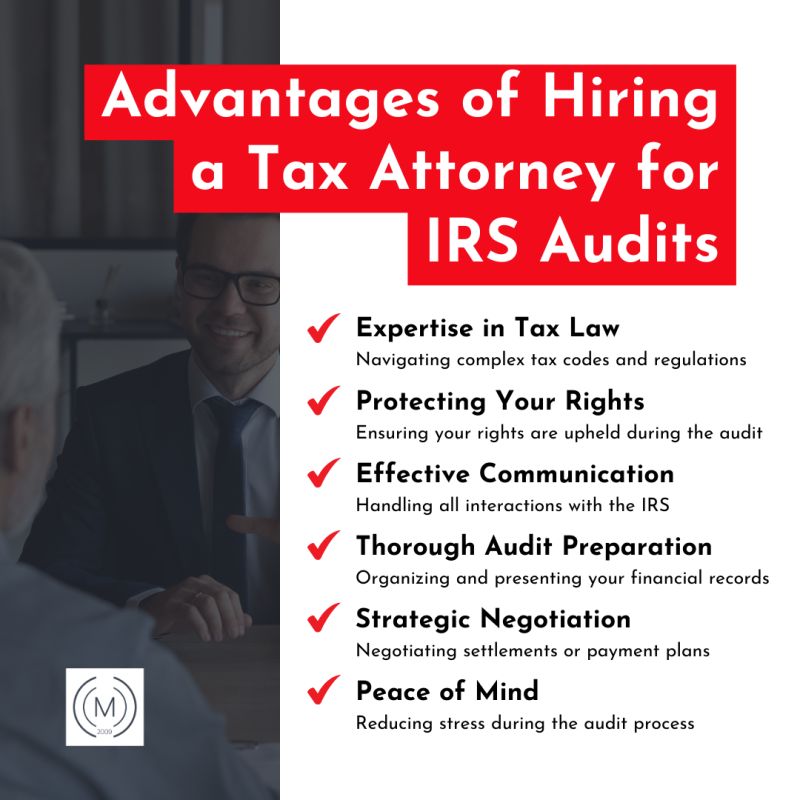

Tax legislations and codes, whether at the state or federal degree, are as well made complex for many laypeople and they alter frequently for lots of tax obligation experts to stay up to date with. Whether you simply need a person to aid you with your company revenue tax obligations or you have been charged with tax scams, work with a tax obligation lawyer to assist you out.

See This Report about Matthew J. Previte Cpa Pc

Everybody else not just dislikes dealing with taxes, however they can be outright worried of the tax obligation firms, not without reason. There are a couple of concerns that are always on the minds of those that are managing tax troubles, including whether to employ a tax obligation lawyer or a CPA, when to hire a tax lawyer, and We want to help address those questions here, so you recognize what to do if you discover on your own in a "taxing" situation.

An attorney can represent clients before the internal revenue service for audits, collections and charms yet so can a CERTIFIED PUBLIC ACCOUNTANT. The big distinction right here and one you need to maintain in mind is that a tax legal representative can supply attorney-client privilege, indicating your tax obligation legal representative is exempt from being obliged to affirm against you in a law court.

The Only Guide to Matthew J. Previte Cpa Pc

Otherwise, a certified public accountant can testify versus you also while helping you. Tax obligation attorneys are much more acquainted with the various tax obligation settlement programs than the majority of Certified public accountants and understand just how to choose the very best program for your situation and exactly how to obtain you gotten that program. If you are having an issue with the IRS or just inquiries and concerns, you need to work with a tax attorney.

Tax Court Are under examination for tax fraudulence or tax evasion Are under criminal investigation by the internal revenue service Another essential time to work with a tax obligation lawyer is when you get an audit notification from the internal revenue service - tax lawyer in Framingham, Massachusetts. https://www.giantbomb.com/profile/taxproblemsrus1/. An attorney can communicate with the IRS on your part, be present throughout audits, assistance bargain negotiations, and keep you from overpaying as a result of the audit

Component of a tax attorney's responsibility is to keep up with it, so you are secured. Ask around for a skilled tax obligation attorney and examine the web for client/customer evaluations.

The Main Principles Of Matthew J. Previte Cpa Pc

The tax attorney you have in mind has all of the ideal qualifications and testimonies. Should you hire this tax attorney?

The decision to work with an IRS lawyer is one that ought to not be taken gently. Attorneys can be very cost-prohibitive and complicate matters unnecessarily when they can be dealt with relatively easily. In basic, I am a huge proponent of self-help legal solutions, specifically provided the range of educational product that can be found online (including much of what I have published when it come to taxation).

Little Known Facts About Matthew J. Previte Cpa Pc.

Here is a fast list of the matters that I think that an internal revenue service lawyer ought to be worked with for. Allow us be entirely straightforward momentarily. Lawbreaker charges and criminal examinations can damage lives and lug really significant effects. Anybody that has actually spent time behind bars can fill you know the truths of prison life, but criminal costs typically have a much a lot more punitive effect that lots of people stop working to take into consideration.

Wrongdoer costs can additionally lug extra civil fines (well beyond what is regular for civil tax matters). These are just some examples of the damage that also simply a criminal fee can bring (whether or not a successful sentence is inevitably acquired). My point is that when anything potentially criminal develops, even if you are simply a possible witness to the matter, you require a skilled internal revenue service attorney to represent your passions against the prosecuting agency.

Some may cut short of absolutely nothing to get a conviction. This is one circumstances where you always require an internal revenue service attorney enjoying your back. There are numerous components of an IRS lawyer's job that are seemingly routine. A lot of collection matters are taken care of in about similarly (although each taxpayer's conditions and goals are different).

All About Matthew J. Previte Cpa Pc

Where we gain our stripes however gets on technical tax issues, which placed our complete capability to the test. What is a technical tax obligation issue? That is a difficult inquiry to address, but the very best method I would define it are issues that require the professional judgment of an internal revenue service lawyer to solve appropriately.

Anything that has this "truth reliance" as I would certainly call it, Massachusetts you are mosting likely to intend to generate an attorney to seek advice from - Federal Tax Liens in Framingham, Massachusetts. Even if you do not preserve the solutions of that lawyer, an expert viewpoint when managing technical tax matters can go a long method toward comprehending issues and resolving them in an appropriate fashion

Report this page